VAT returns without

bending over backwards

Submit your VAT returns from your spreadsheet with our simple, affordable bridging software.

- Great pricing - only £8.99 per VAT submission.

- Supports Excel, OpenOffice and Google Docs.

- No obligations.

Quick and easy VAT returns from your spreadsheet

Feeling forced by Making Tax Digital (MTD) regulations to use expensive and complicated bookkeeping software is frustrating when your spreadsheet works just fine.

VATMonkey offers an alternative - simple bridging software that acts as an intermediary between your spreadsheet and HMRC, so you keep the simplicity of your spreadsheets while meeting your regulatory requirements.

How is VATMonkey different?

VATMonkey is a different in three main ways:

Just bridging software,

simple and easy

VATMonkey is only about submitting VAT returns, we're not trying to sell anything else - so it's easy to use.

Learn more

No obligations -

great pricing

Freedom from subscription fees and the lock-in of bookkeeping software. Pay only £8.99 per VAT submission, that's it.

Learn more

Works with all spreadsheet editors not just Excel

VATMonkey uses a simple `=HYPERLINK()` spreadsheet formula, so it works with every spreadsheet.

How does it work?

VATMonkey provides a bridge to HMRC when you need to submit a VAT return. Submitting a VAT return with VATMonkey is quick (a couple of minutes) and easy (a couple of clicks)...

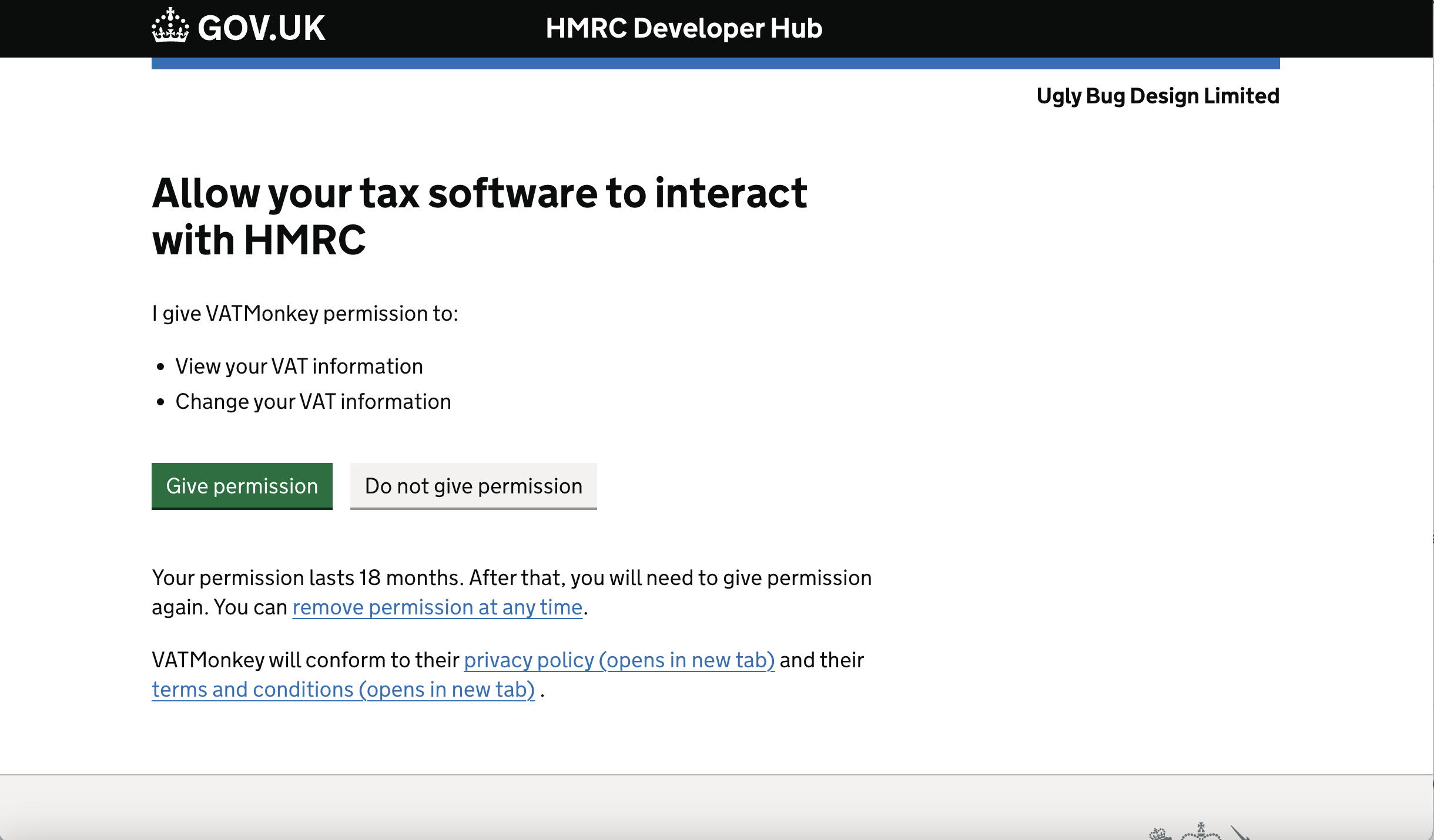

1. Connect to HMRC

Connect and authorise VATMonkey using Government Gateway.

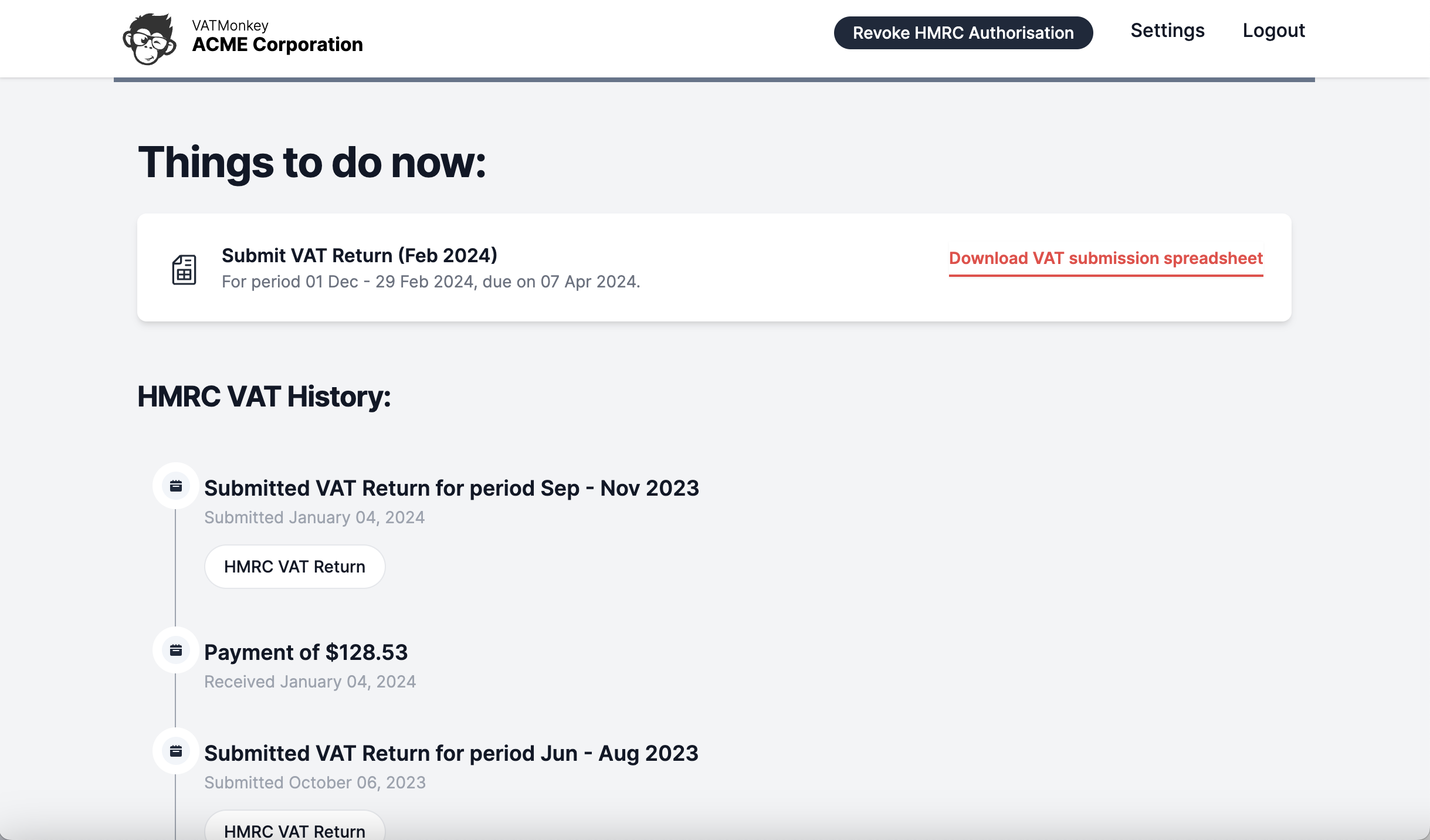

2. Download submission sheet

Add the VATMonkey submission sheet to your bookkeeping spreadsheet.

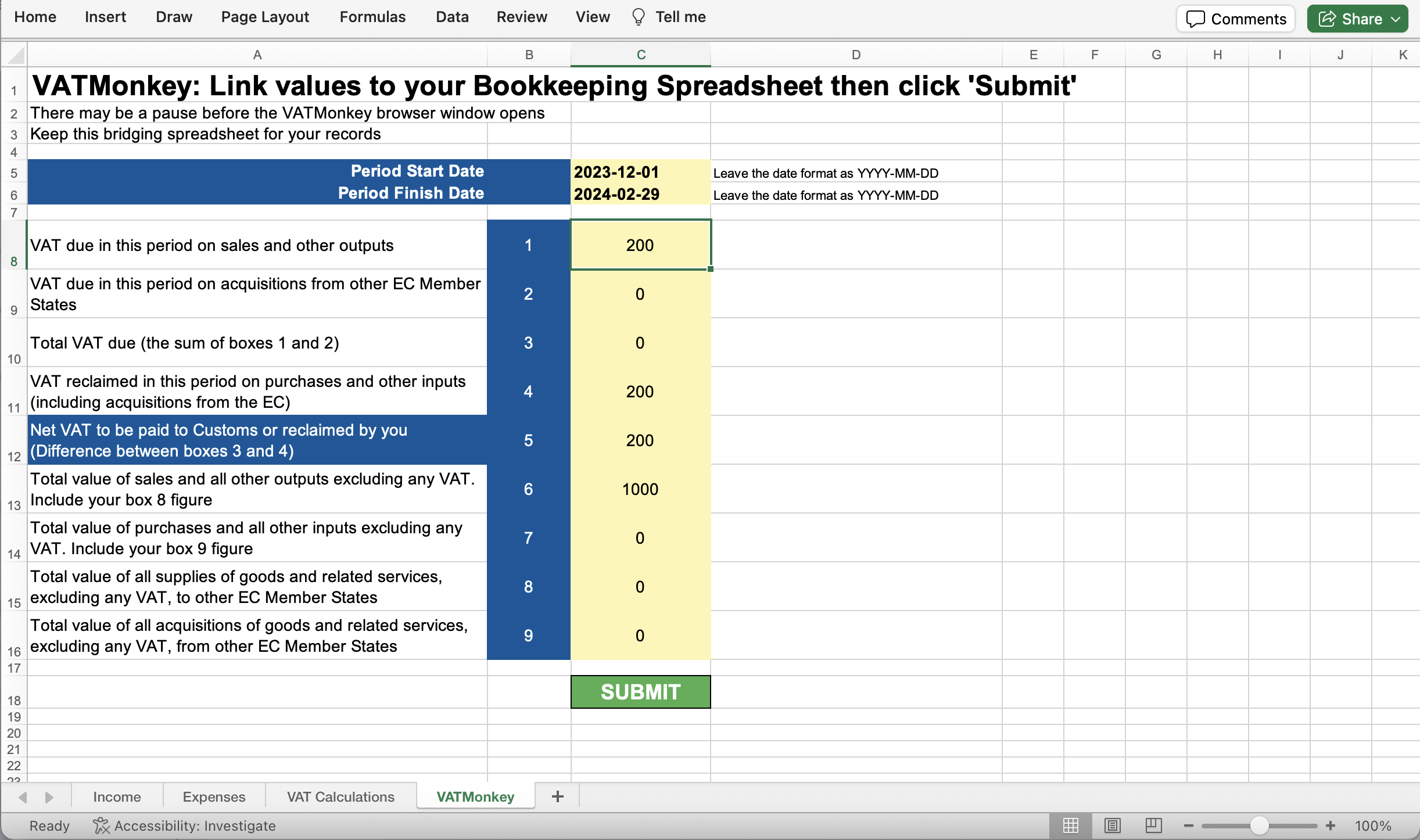

3. Link to your spreadsheet

Link to the values in your bookkeeping spreadsheet.

4. Submit and pay

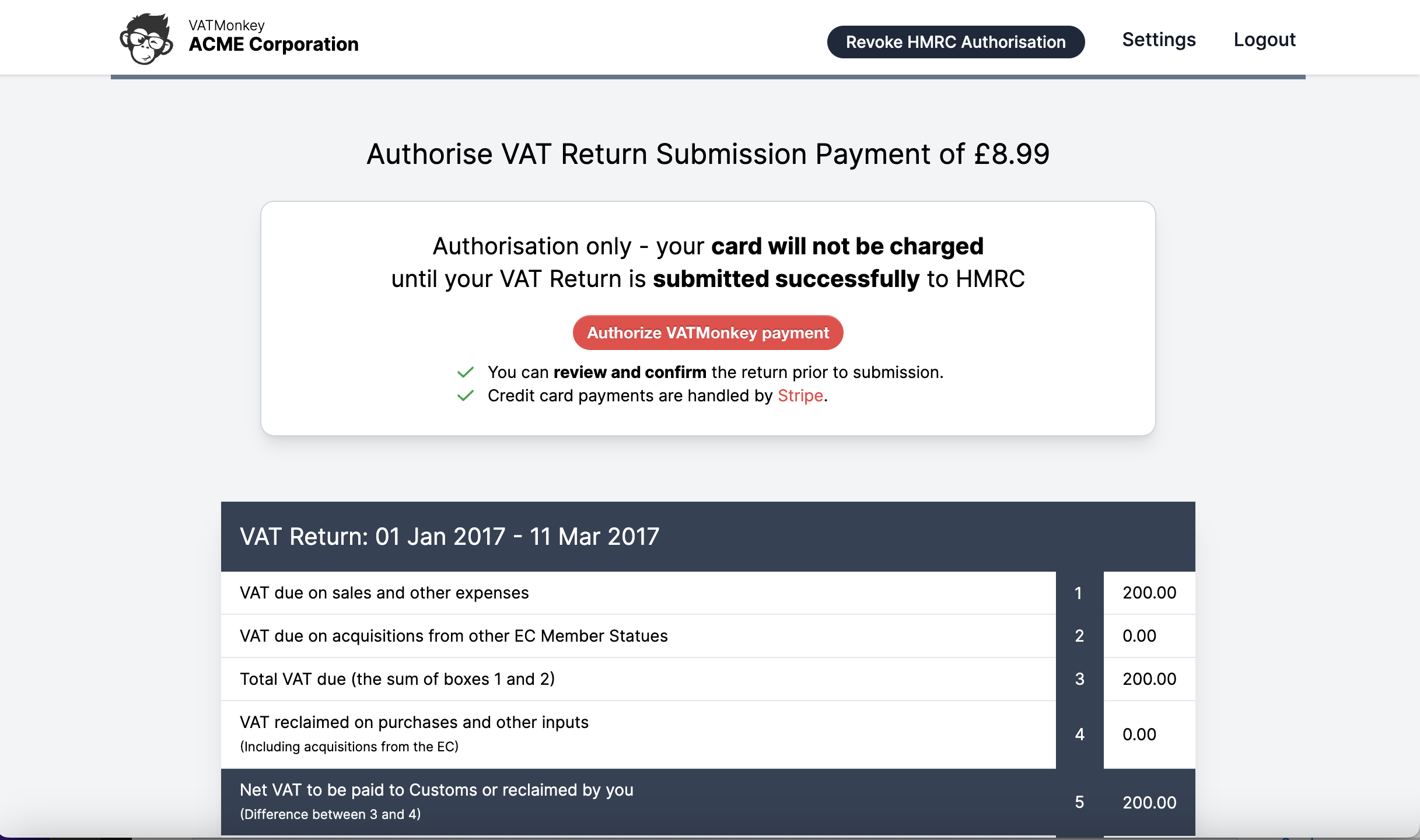

Click "SUBMIT" on the spreadsheet then authorise your VATMonkey submission payment.

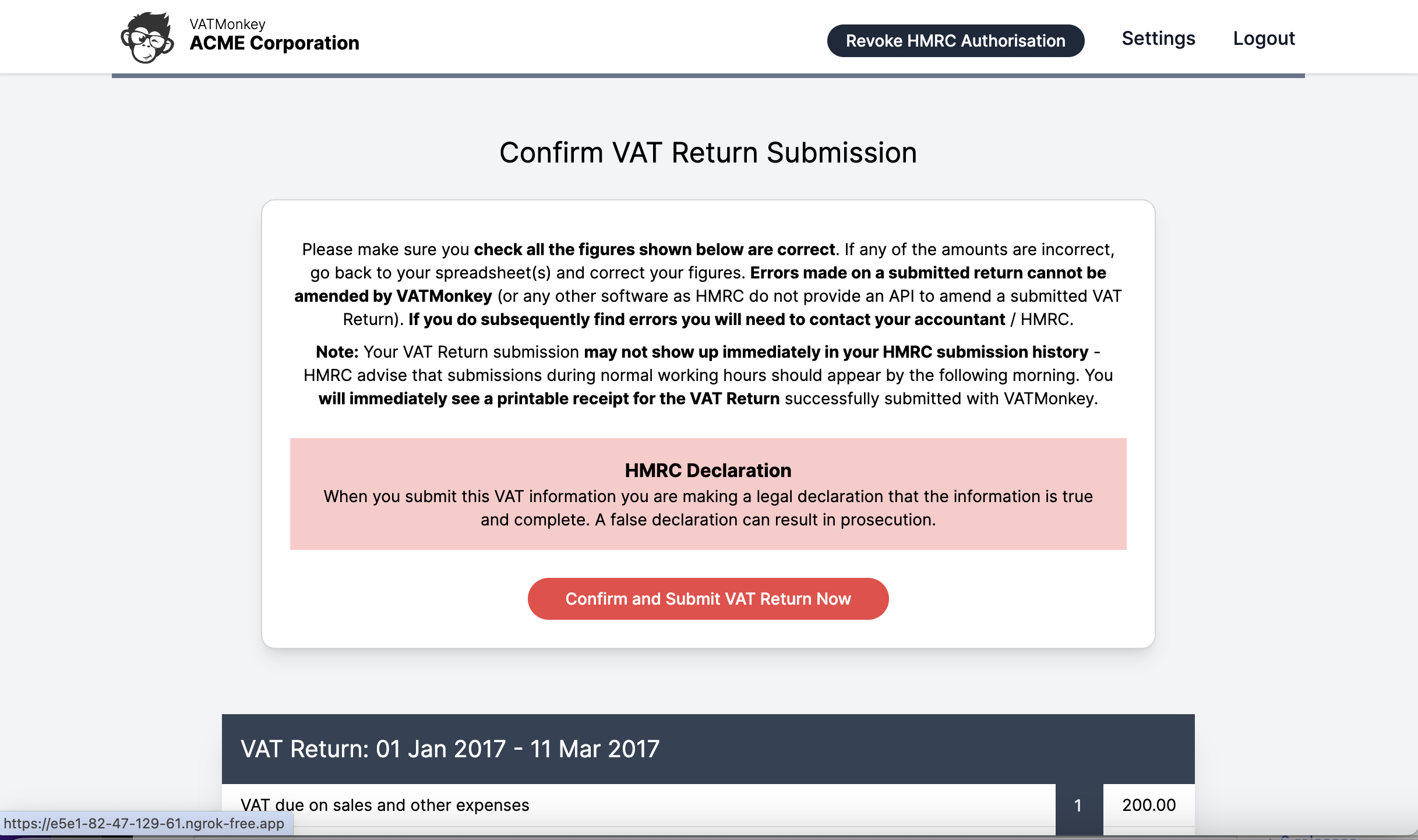

5. Review and submit to HMRC

Do a final check and click "Confirm and Submit to VAT Return Now" to send to HMRC.

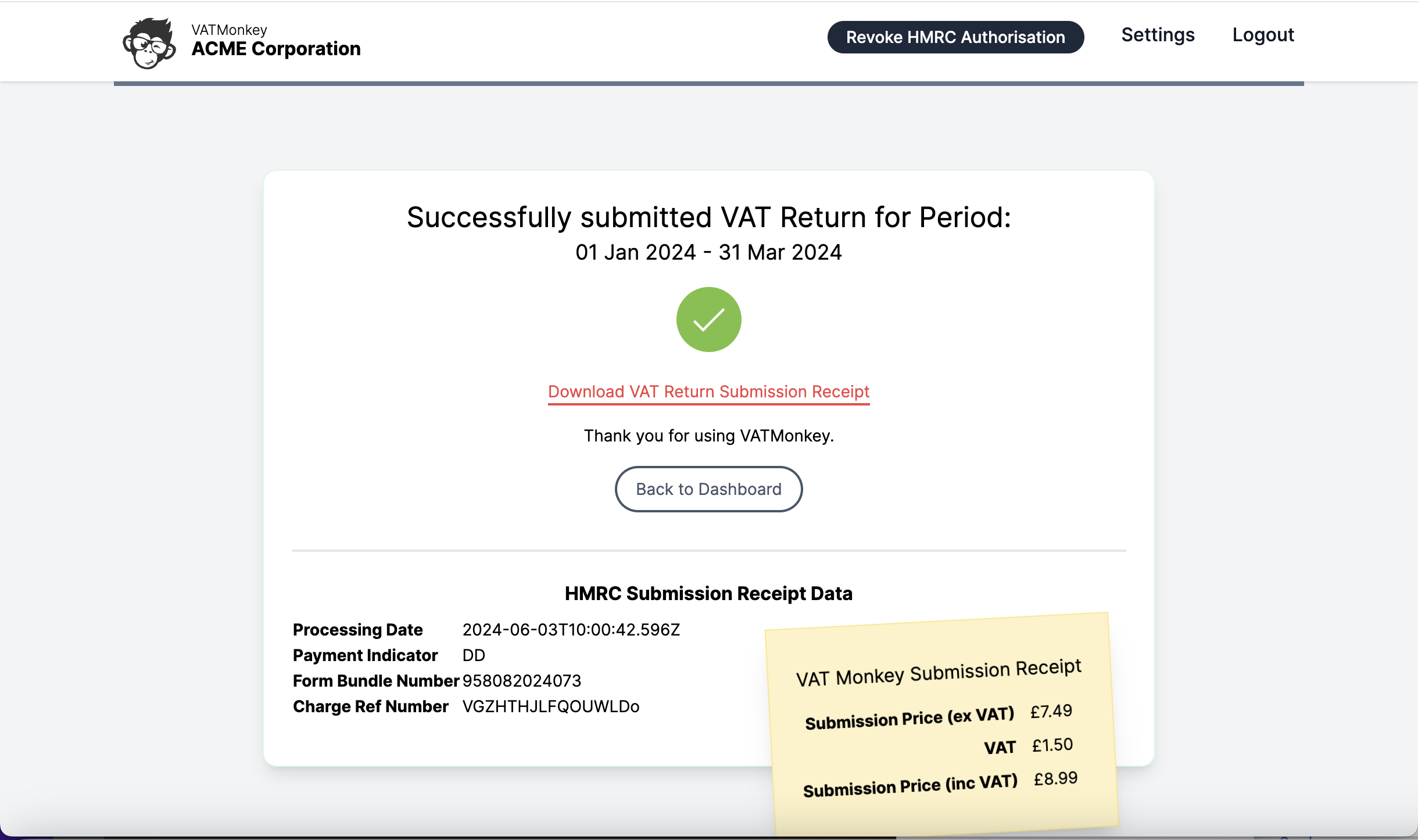

6. That's it!

Your VAT Return has been submitted, now you just have to pay your outstanding VAT.

Frequently asked questions

Here are a few of the questions we get the most.

Yes, absolutely! VATMonkey has been through HMRC’s recognition process. You can see us in the list of HMRC recognised MTD software here:

https://www.tax.service.gov.uk/making-tax-digital-software

VATMonkey costs £8.99 per VAT return successfully submitted, no obligations, no subscription fees. You can pay using any debit or credit card and download a VAT receipt for the submission payment.

VAT bridging software is a digital tool designed to seamlessly connect your spreadsheet to HMRC for Value Added Tax (VAT) submissions. It acts as an intermediary, facilitating the transmission of VAT data from your existing spreadhseet to HMRC's systems, ensuring compliance with MTD regulations.

The great thing about bridging software is its simplicity and convenience. Bridging software doesn't alter or store your bookkeeping records. Your data remains safely within your existing spreadsheet. The bridging software simply acts as a conduit, passing the necessary information for VAT submissions. This ensures that you can continue to manage your accounts your way.

There is no way to correct VAT return errors using MTD compliant tools. Instead you need to contact HMRC directly.

You can do so here:

https://www.gov.uk/guidance/check-if-you-need-to-report-errors-in-your-vat-return

Bridging software itself doesn't make any calculations. Instead all calculations are performed within your spreadsheet. This means you retain full control over your financial data and calculations.

Unlike online bookkeeping services where you have to trust that your data is stored safely, with VAT bridging software your financial data remains in your existing spreadsheet. As bridging software VATMonkey acts solely as a conduit for transmitting VAT data to HMRC, without altering or storing your sensitive financial information.

VATMonkey uses Stripe to handle your credit card payments, so your credit card details are never stored on our servers. Instead they're securely processed by Stripe directly, ensuring your information remains safe and protected throughout the transaction.